Over the past 4 years, airdrops have evolved from a nice surprise for early adopters to a mutualist relationship between farmers and protocols. During this time, perceptions on both sides of the protocol–user interaction have changed:

- In most cases, early adopters' main motivation when trying out a new protocol is now the expectation of an airdrop. Nothing else. They may not even be interested in what the protocol itself does or what problem it's trying to solve. Their main motivation is accruing token rewards.

- Protocols, on the other side, have realized that they have the power to shape this relationship through incentive programs. Approaches here differ: while some protocols publish which user behaviours they will reward very clearly and early on, others decide not to give a single hint until the airdrop date.

As we'll show in this article, the power of well‑thought incentive structures is significant. This alone can be the key difference between a thriving protocol or a dead one. And even when being the underdog, this allows new protocols to compete head‑to‑head with previous incumbents.

Mastering incentive design will only become more important over time. Protocols that fail to understand this and how to allocate their incentives will fail against similar products with better‑thought user reward programs.

The power of clear communication

Before diving into what to incentivize, it's crucial to understand the importance of clear communication in any incentive strategy. Protocols should effectively convey their values and reward structures to their user base from the very beginning. Here's why:

- Guiding user behavior: Without clear direction, users tend to mimic behaviors rewarded in previous campaigns, which may not align with the current protocol's goals.

- Preventing wasted user effort: Clear communication helps prevent wasted user effort.

- Fostering trust and engagement: Transparency about incentives builds trust and encourages more active, aligned participation from the community.

Ultimately, incentive programs should be viewed as disbursements from protocols to users in exchange for a service. What this service looks like is very case‑dependent, but under this framework it's clear that protocols need to be vocal about the service they are requesting and under which circumstances they will provide payment. This naturally leads to better alignment.

Let's examine two case studies that highlight the impact of communication on incentive programs.

Scroll: TVL, productive TVL, and incentives as the catalyst

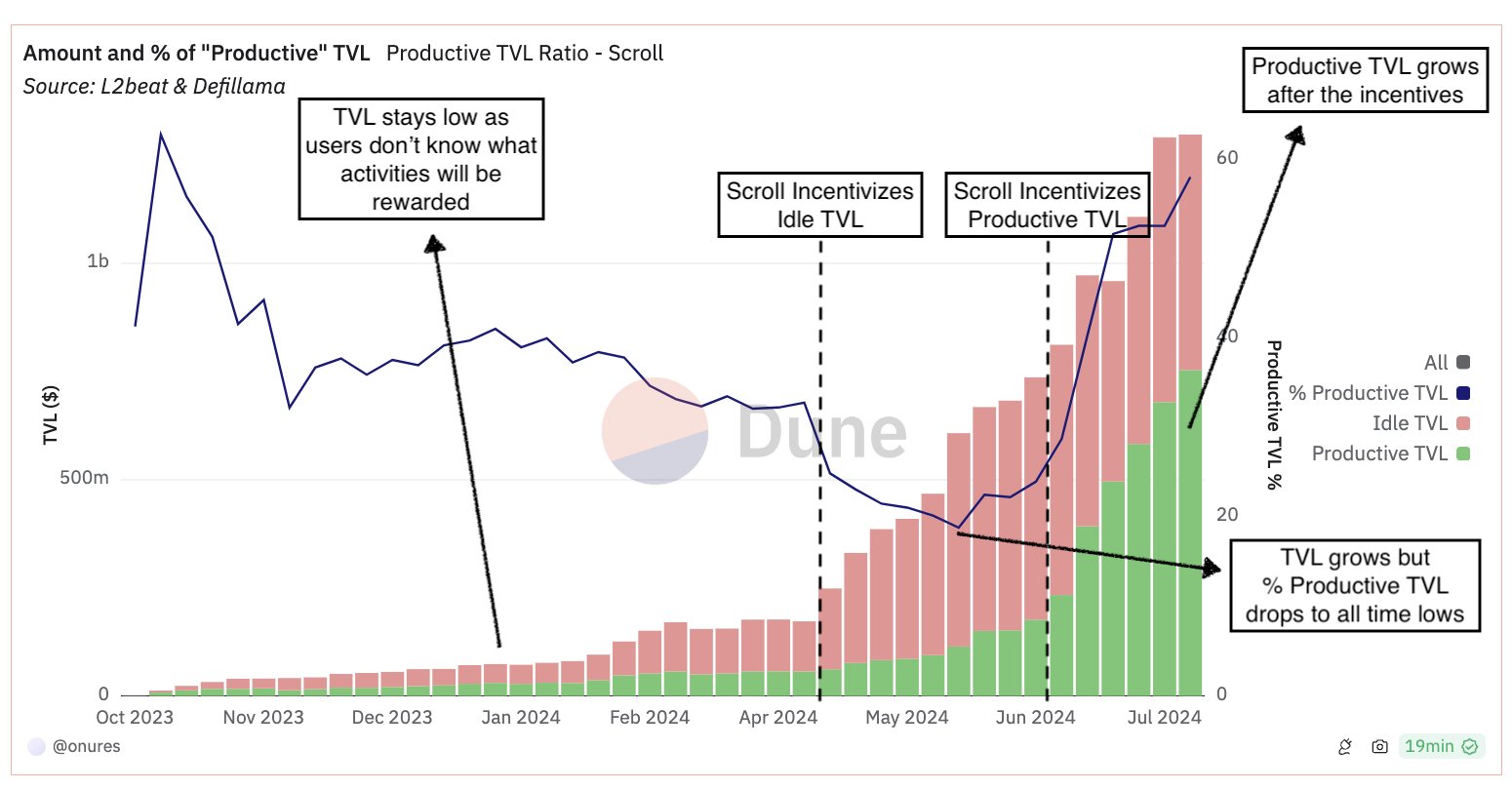

Scroll is a great example of the impact that evolving incentive programs coupled with clear communication can have. Over the past year, Scroll revised their approach to incentives in three distinct phases. We look at TVL and productive TVL (pTVL) over those periods. We define pTVL as the value locked in protocols like DEXes or lending markets; the higher pTVL is, the better the user experience should be (lower slippage, lower borrowing rates).

Scroll TVL, pTVL, and pTVL ratio over time. Sources: Dune, L2Beat, DefiLlama.

Scroll TVL, pTVL, and pTVL ratio over time. Sources: Dune, L2Beat, DefiLlama.

- Phase I – Initial uncertainty: No incentive program; both TVL and pTVL remained low.

- Phase II – Broad incentives: Scroll's first incentive program rewarded bridging funds to Scroll and holding idle funds. TVL increased but the pTVL ratio decreased.

- Phase III – Targeted incentives: Rewards focused on pTVL. Both overall TVL and the pTVL ratio rose significantly.

This evolution shows how clear communication and well‑targeted incentives can drive not just growth, but the right kind of growth that benefits the entire ecosystem.

ZKsync vs. Blast: The communication gap

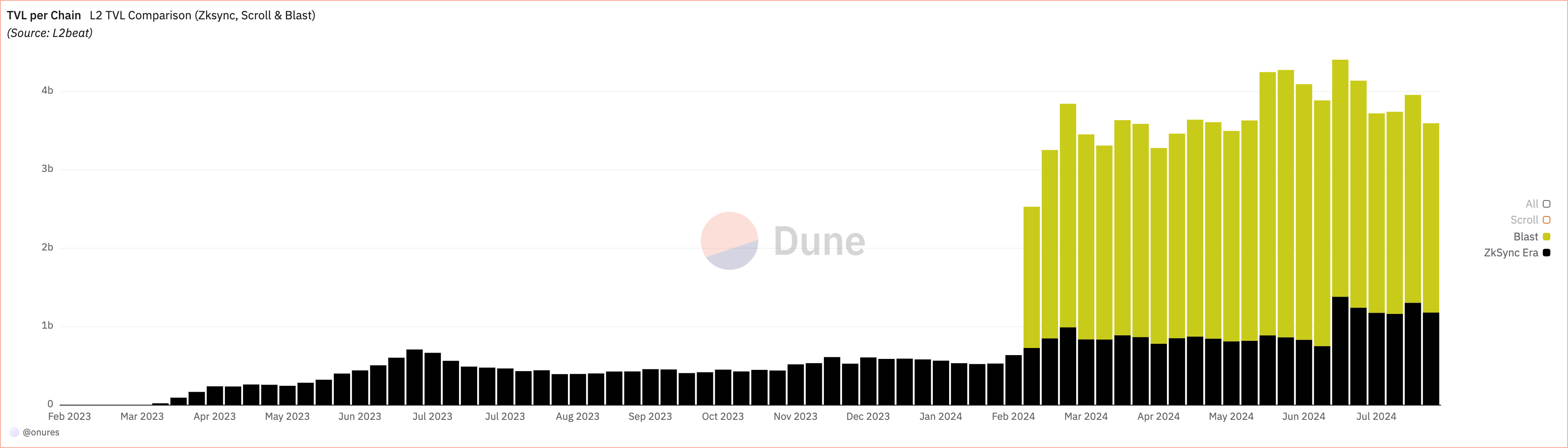

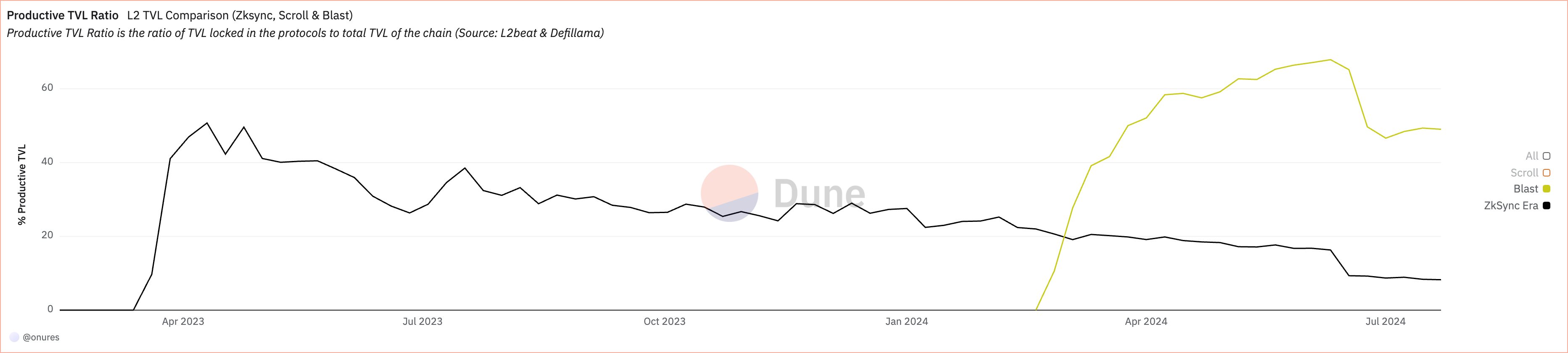

The contrast between ZKsync and Blast further underscores the importance of clear incentives communication:

- ZKsync: Despite its earlier launch and community recognition, ZKsync's lack of clear incentives led to uncertainty among users and suboptimal ecosystem growth.

- Blast: By clearly communicating its goals and introducing distinct point systems (Blast Points and Blast Gold), Blast achieved larger TVL, pTVL, and higher pTVL/TVL ratio—while spending less on incentives.

TVL comparison between ZKsync and Blast. Source: L2Beat.

TVL comparison between ZKsync and Blast. Source: L2Beat.

pTVL comparison between ZKsync and Blast. Sources: L2Beat, DefiLlama.

pTVL comparison between ZKsync and Blast. Sources: L2Beat, DefiLlama.

Pre-airdrop efficacy metrics for ZKsync vs. Blast.

Pre-airdrop efficacy metrics for ZKsync vs. Blast.

It’s important to note that this comparison could be unfair if Blast simply spent significantly more on incentives than ZKsync. Surprisingly, Blast outperformed ZKsync on‑chain metrics while spending significantly less. Blast’s protocol and airdrop efficacy metrics are multiples of ZKsync in all dimensions.

| Metric | ZKsync | Blast | Efficacy ratio |

|---|---|---|---|

| Average TVL | $505.6M | $2,065.0M | 4x |

| Average pTVL | $128.9M | $1,458.8M | 11x |

| Cost per $1 TVL | $2.181 | $0.169 | 13x |

| Cost per $1 TVL/year | $1.648 | $0.282 | 6x |

| Cost per $1 pTVL | $8.550 | $0.240 | 35x |

| Cost per $1 pTVL/year | $6.462 | $0.400 | 16x |

| TVL per 1% token supply | $28.9M | $147.5M | 5x |

| pTVL per 1% token supply | $7.4M | $104.2M | 14x |

What to incentivize?

The answer may sound evident: teams should mainly incentivize whatever makes their product better. Spending incentives to acquire new users is fine to some extent, but teams should mostly focus on spending these in ways that will help the product grow organically. If well thought out, a good incentive program can kickstart a feedback loop that improves the product itself and, ultimately, helps it achieve escape velocity.

Looking at previous high‑profile projects’ incentive programs, we see this has not always been the case. One mistake teams often make is to incentivize their end‑goal metric rather than incentivize behaviors that would help the product grow organically. Examples:

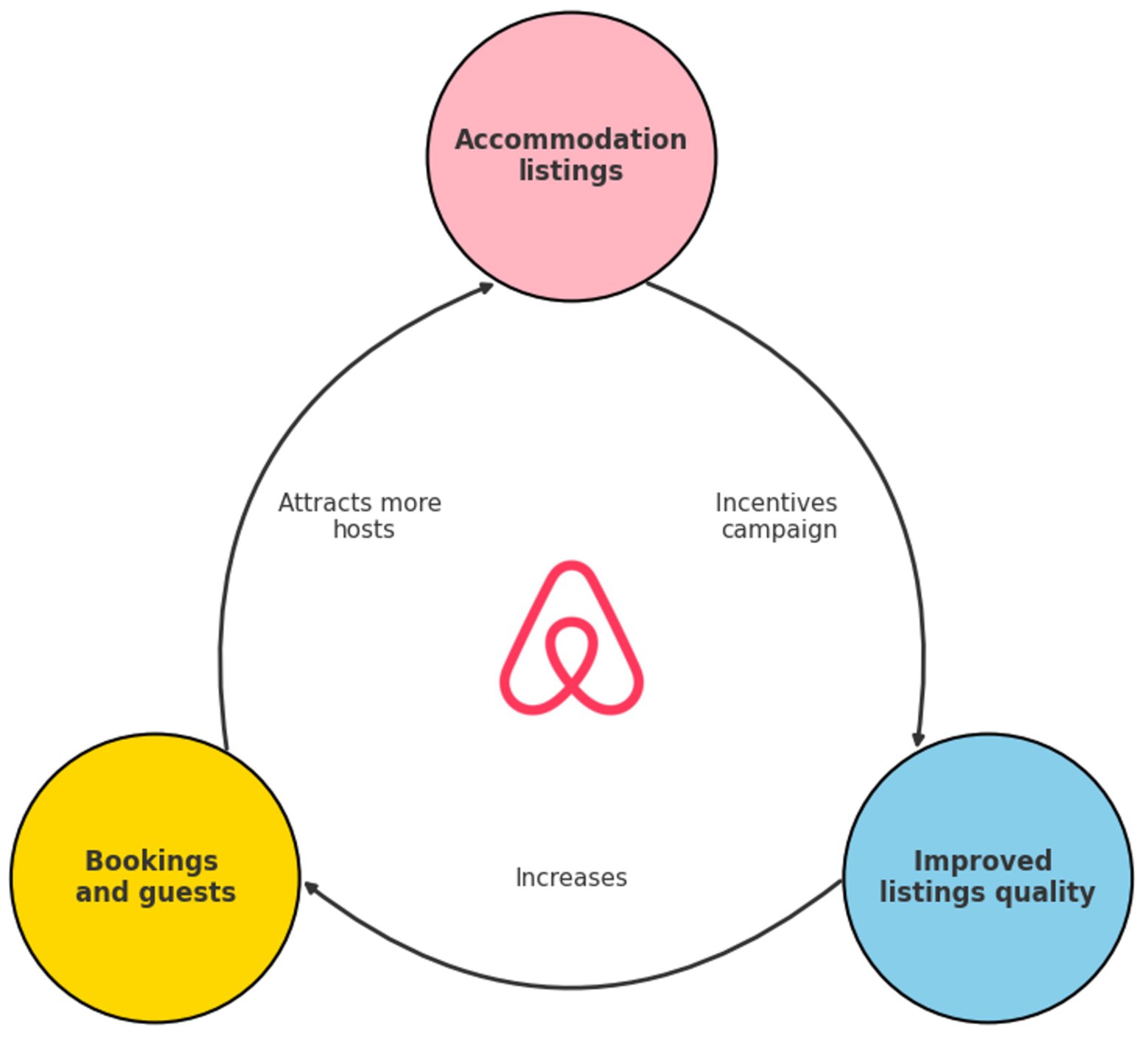

Airbnb’s incentives-powered feedback loop.

Airbnb’s incentives-powered feedback loop.

Incentives in the web2 world: Airbnb

Airbnb's approach offers valuable lessons for crypto protocols. Instead of directly rewarding bookings (Airbnb’s end‑goal), the marketplace focused on improving listing quality through incentives. They offered free professional photography to hosts and prioritized high‑quality listings in search results.

This strategy improved overall listing quality, increased user satisfaction, and translated into more bookings and guests. It attracted additional hosts and listings to the platform, creating a virtuous growth cycle. Even after incentives stopped, listing quality didn’t drop and the cycle could continue through natural marketplace competition. When the music stops, the moat can be too large for competitors to easily catch up.

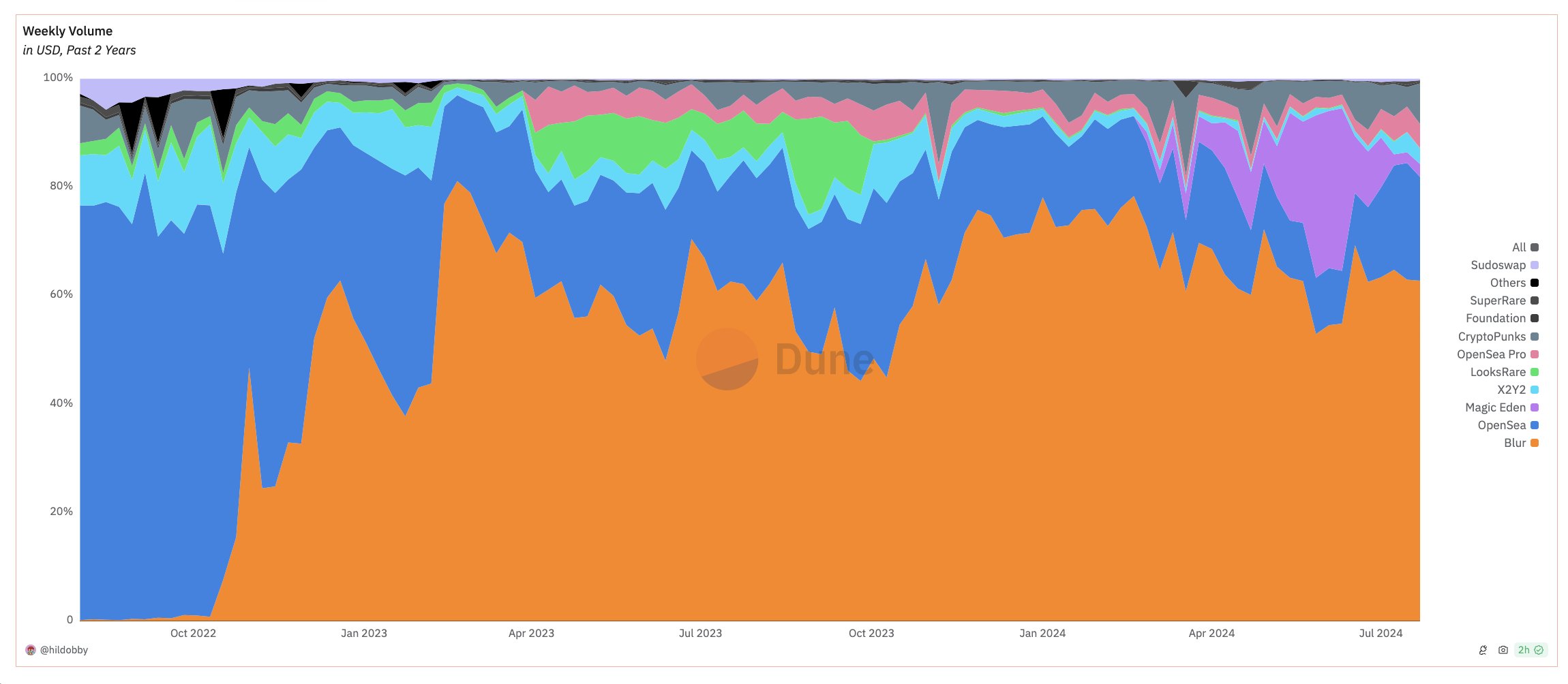

NFT marketplaces’ weekly volume share. Author: Hildobby.

NFT marketplaces’ weekly volume share. Author: Hildobby.

Incentives in the web3 world: LooksRare vs Blur

- LooksRare incentivized trading volume directly (their end metric), leading to high initial activity but ultimately wash trading and little sustainable value.

- Blur focused on incentivizing order‑book liquidity by rewarding behaviors like listing and bidding. This created genuine value for users, improved UX (better prices), and fostered organic growth.

Blur’s targeted incentives deepened marketplace liquidity → better UX → more users → stronger liquidity moat.

When the music stops: sustainability beyond incentives

While well‑designed incentive programs can catalyze remarkable growth quickly, they aren't a silver bullet for long‑term success. The case of Blast provides an insightful example of both the power and limitations of incentives in crypto.

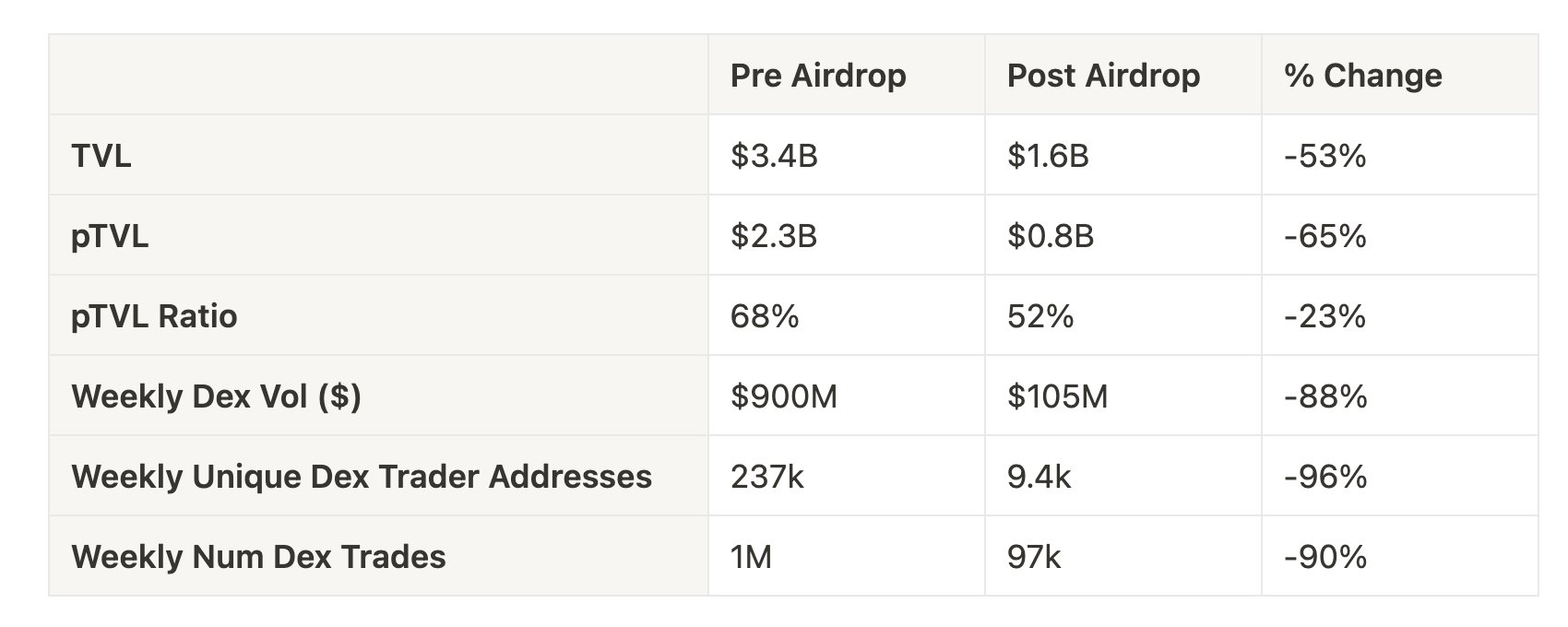

Blast pre/post airdrop TVL, pTVL, DEX volume, number of trades.

Blast pre/post airdrop TVL, pTVL, DEX volume, number of trades.

Blast pre/post airdrop % change in key metrics.

Blast pre/post airdrop % change in key metrics.

Blast's Season 1 incentive program was, by many metrics, a success—high efficacy in attracting users and capital, outperforming many established players in TVL and pTVL growth. But after Season 1 ended, a mass migration of users and capital occurred. Post‑airdrop stats show sharp declines across key metrics.

This highlights two critical points:

- Incentives alone cannot substitute for a genuine product with PMF that solves a real problem. Blast, as a general‑purpose L2, competes in a crowded vertical; native yield may not be enough differentiation.

- Incentives can solve cold starts, but programs must evolve toward organic activity and sticky users. Season 1 solved the cold start, but hasn’t yet converted that “hot start” into sustainable demand.

Incentive flywheel in reverse once rewards dry up.

Incentive flywheel in reverse once rewards dry up.

When incentives dry up, the growth flywheel can operate in reverse:

- Mercenary users and capital leave for more lucrative opportunities.

- UX degrades.

- Organic users leave.

- Developers, seeing declining users, may abandon the platform.

Takeaways

- Communicate expectations clearly. As Scroll and Blast show, clarity guides user behavior, prevents wasted effort, and builds trust.

- Incentivize behaviors that lead to sustainable growth. Prioritize incentives that improve product and UX (Airbnb, Blur) instead of vanity metrics.

- Recognize incentives as catalysts, not cure‑alls. They can drive rapid growth and solve cold starts, but cannot substitute for a strong product. Transition from incentive‑driven to organic adoption.

As the crypto ecosystem matures, protocols that balance strong products with well‑crafted incentives will thrive. Many thanks to ergokhaner (IOSG), dorukismen (Scroll), Ethernal (Optimism), vasadevelop & karinadoteth (OpenSea), sushiwarriorx (AltLayer) and others for their feedback and discussions that contributed to this post.