Today, if you want to build any decentralized app, you don’t need to launch your own chain from scratch; you can simply build your smart contracts on Ethereum, and your app inherits Ethereum’s decentralization and security.

So, Ethereum provides trust as a service to apps.

This wasn’t possible before Ethereum. If you wanted to build a name service like ENS, you couldn’t build it on top of Bitcoin.

But when someone builds a new infra project, such as a new oracle protocol, they need to build a decentralized validator set from scratch. THIS IS A PROBLEM !!!

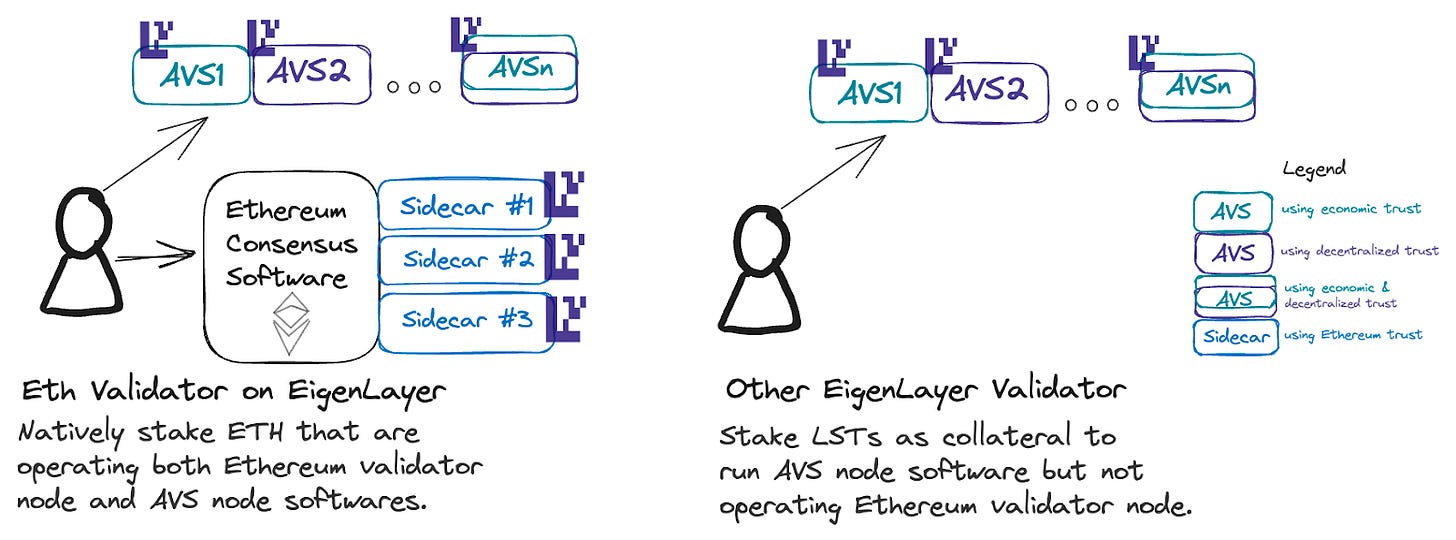

That’s what Eigenlayer solves. It allows the Ethereum validator set to verify other protocols by restaking their staked ETH and expand the decentralized trust of Ethereum.

So using eigenlayer, the Ethereum validator set can provide TRUST as a service to the INFRA PROJECTS.

I hope you see a pattern here. Eigenlayer solves a major problem for decentralized infrastructure, just like Ethereum solved a major problem for decentralized apps.

Why would protocols use Eigenlayer?

Ok, you get the idea, but you may be asking “why would protocols borrow Ethereum’s security and pay “rent” instead of finding their own stakers?” If you’re asking this, congrats, because this is a really good question.

First, let’s take an example from web2. In web2, almost all tech companies opt for AWS or other cloud providers over building their own on-premises servers. They constantly pay “rent” to AWS. Why?

- Innovation & speed: Deploying on the cloud is faster, accelerating product development.

- Cost-efficiency: Clouds convert large upfront costs into predictable operational expenses.

- Scalability: Cloud services easily adjust to demand, avoiding wasted resources.

These also apply to web3 protocols.

- Innovation & speed: Protocols can focus on their core product instead of spending lots of time trying to onboard stakers as validators to their protocol. They can go to Eigenlayer and find validators easily.

- Cost-efficiency: ETH staking yields ~3% APR, and ETH is a relatively stable asset with good store of value properties. For anyone to hold another crypto asset and stake it for years, it needs to have a very high APR compared to ETH. Also, people don’t want to hold crypto assets that can lose 99% of their value, especially in bear markets.

- Scalability: As a protocol grows, the amount of economic security it needs would also grow. Protocols can easily adjust the payment to attract more economic security on Eigenlayer.

So, for protocols, Eigenlayer is an efficient and easy way to find a decentralized validator set.

As protocols become more mature, they can gradually transition into building their own validator sets.

Let me summarize what we discussed so far:

- In the current state, applications built on Ethereum leverage Ethereum’s security.

- But infrastructure projects that operate outside Ethereum can’t use Ethereum’s security; they need to create their own decentralized network to launch their protocol.

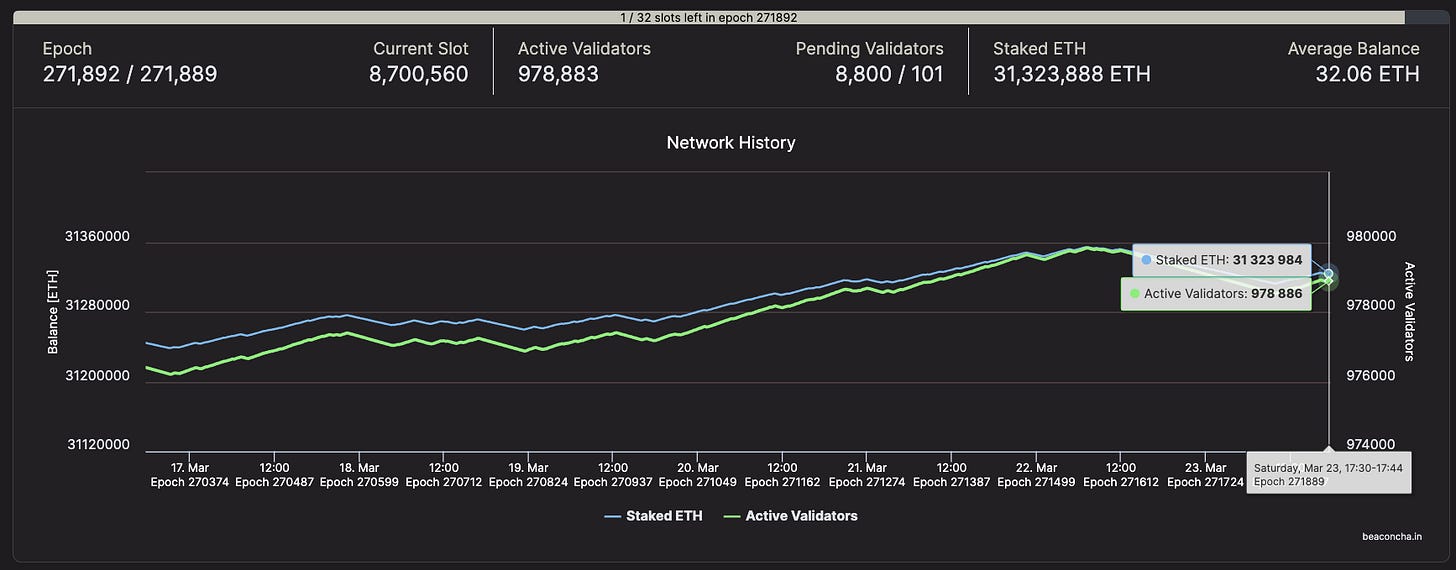

- Ethereum has ~1M validators that provide more than 31M ETH ($100B) economic security.

- Eigenlayer enables the Ethereum validator set to verify other infrastructure protocols.

- This is helpful for protocols because, during the launch, they no longer need to think about how/where to find stakers.

As protocols mature, they can gradually transition to their own validator sets if they choose.

Why would ETH stakers restake their ETH?

Ok so protocols want to use Ethereum’s cryptoeconomic security. But why would ETH stakers take additional risk by exposing their capital to additional slashing conditions?

The answer is yield.

By securing other protocols (AVSs), validators earn more yield in addition to native ETH staking yield.

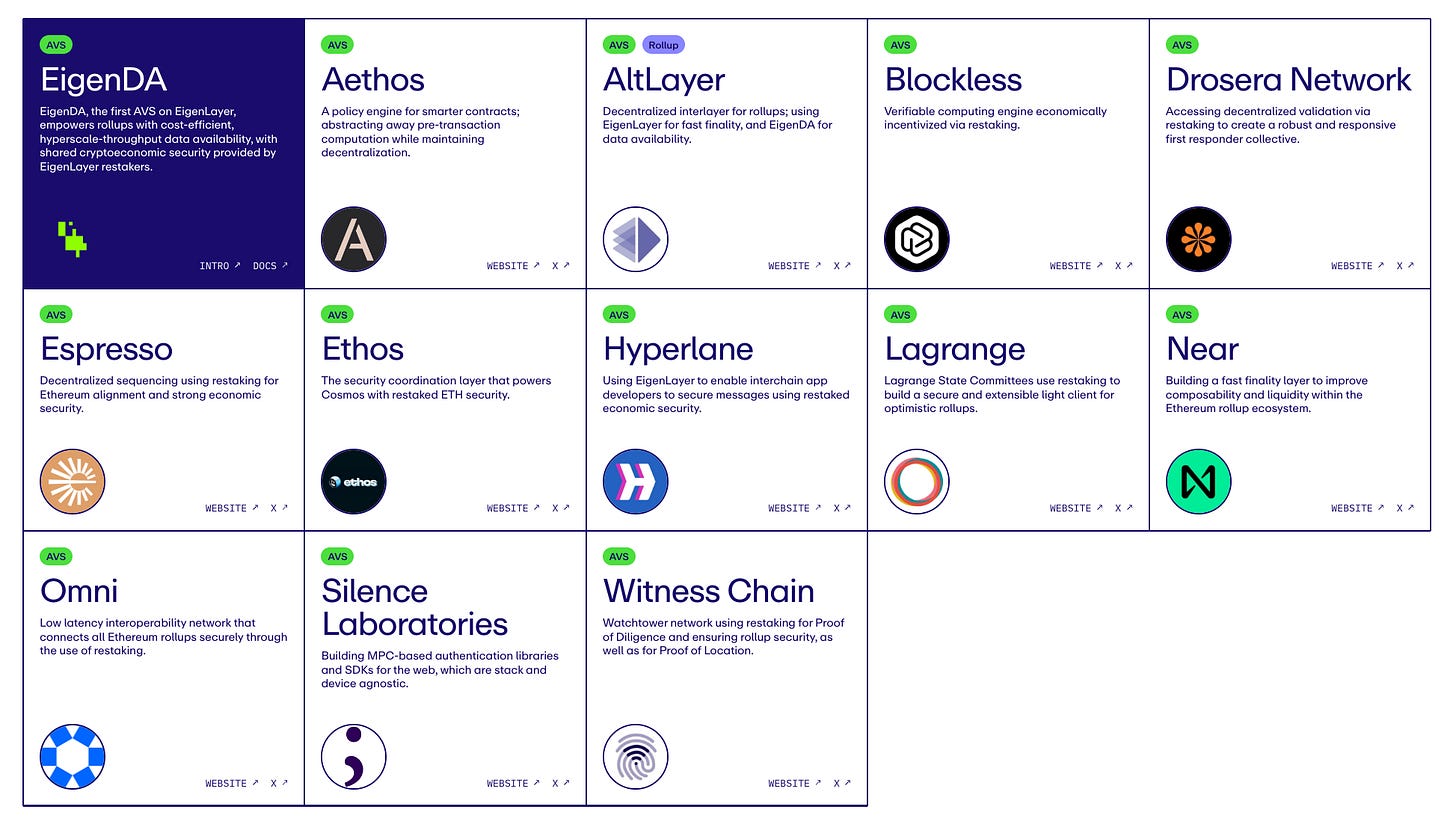

The first AVS to be launched, EigenDA, is created by Eigen Labs.

All of these AVSs below and many more that are not in the picture will be using eigenlayer to tap into Ethereum’s decentralized trust.

Initial AVSs planned on Eigenlayer.

Initial AVSs planned on Eigenlayer.

Properties of decentralized trust

I haven’t explained why the asset that we restake is staked ETH.

If the purpose of staking is providing slashable capital at risk, we could stake any asset; it doesn’t have to be staked ETH. WBTC, USDC, or bored apes would work just as well.

Well, maybe not bored apes, but the other two would work pretty well.

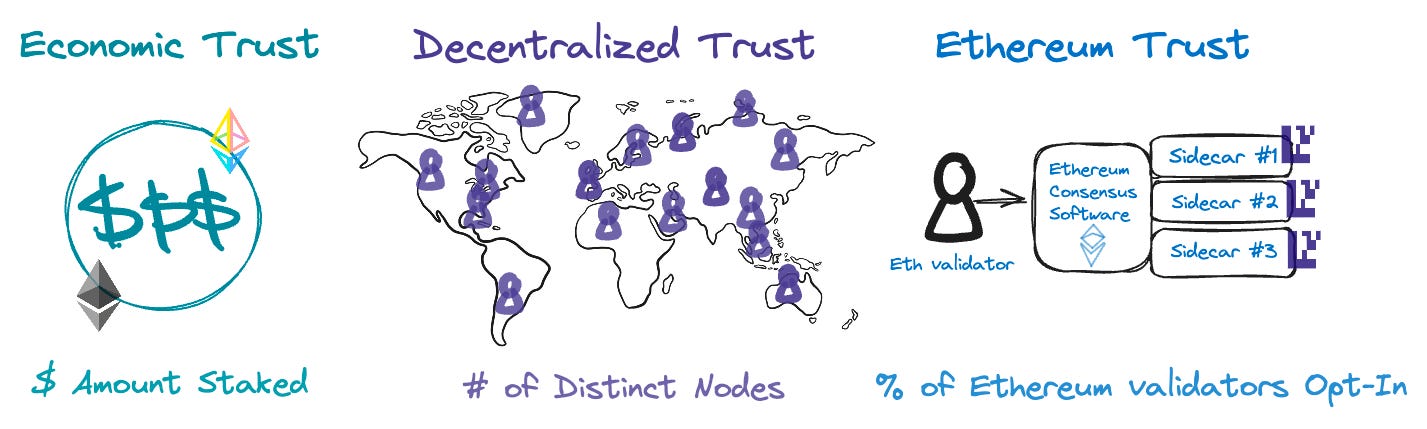

To answer why staked ETH is the asset, we need to dive into the properties of decentralized trust:

-

Economic trust — The slashable capital at stake. Some protocols may only care about the total economic trust backing the protocol. This economic trust may come from thousands of individual stakers, or it may come from just one person. This has nothing to do with why Eigenlayer uses staked ETH. Staking USDC would work just as well.

-

Decentralized trust — Trust from having a decentralized network operating by independent and geographically isolated operators. For some applications, such as secure multiparty computation, you need the validator set to be decentralized. In its current form, decentralization is something we all want, we all value, we talk about, but we don’t pay for it. There is no direct incentive mechanism. But if decentralization is really important and valuable, why not pay for it? Protocols that require decentralized trust would actually “pay” for more it and having a marketplace for decentralized trust creates a force that pushes the validator set to be more decentralized. But it still doesn’t explain why the asset has to be staked ETH. We could still use USDC as the asset we stake; it’d work just as well.

-

Ethereum inclusion trust — Having ETH stakers as the restakers on Eigenlayer opens up a whole new design space. Now, restakers can make credible commitments on how to order blocks as block proposers. This is only possible if the restaker = ETH staker. This design space is so vast, but to give you an example, restakers can commit to trigger all the lending liquidations within 2 blocks. If they don’t trigger those, they get slashed. This allows greater capital efficiency for the lending protocol because they know that all the liquidations will get triggered within 2 blocks. This is the reason why Eigenlayer uses staked ETH as the asset to be staked on Eigenlayer

So far, I've touched on:

- why protocols would want to use Eigenlayer

- why stakers would stake their assets on Eigenlayer

- why that asset is staked ETH

Eigenlayer is a very complex marketplace that involves several parties: LRTs, AVSs, operators, stakers, and Eigenlayer itself as the marketplace that connects them.

I haven’t touched the interaction between these parties, what kind of protocols are made possible with Eigenlayer, or risks involved.

If you’re curious about eigenlayer, please check the following resources:

- On Liquid Restaking: Risks & Considerations

- EigenLayer Risks Q&A

- You Could've Invented EigenLayer

- Eigenlayer Universe: 15 Unicorn Ideas

- Three Pillars of Programmable Trust

See you on the next one! 🙌